Interactive Brokers

The app has a very classy interface and provides each and every information which is required for a person to look for and the app also has a very clear access and that’s a very good and attractive. Here, a movement in the second decimal place constitutes a single pip. This is often known as a custodial or platform fee but it can have other names too. With its beginner friendly trading platforms, uncomplicated trading experience and commission free trades, Robinhood is among the best brokers for those just getting started in investing. It is a viral platform that you can download for free. The trading session on May 18 will be carried out in two parts. Com and is respected by executives as the leading expert covering the online broker industry. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance. The notion of dabba trading is thought to have originated in Gujarat, where it swiftly gained favour among dealers and investors looking to avoid stock market laws and costs. Traders who believe the tech sector is primed to surge can hop on QQQ to amplify their potential returns across a broad base of stocks. The investment strategies mentioned here may not be suitable for everyone. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. On the OANDA mobile platform, it is shown as Max Position Size in the instrument information section. ARROW API enables developers to build automated trading solutions on the Algomojo infrastructure. A 1:1 risk/reward ratio will be reached at $20. Access DeFi protocols and get rewarded. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of. MCX offers a diverse range of commodities for trading, including gold, silver, crude oil, natural gas, copper, zinc, lead, nickel, and aluminium.

Improve performancepractice tradingreduce mistakesfind trade ideasautomate trade trackingsimulate your trades

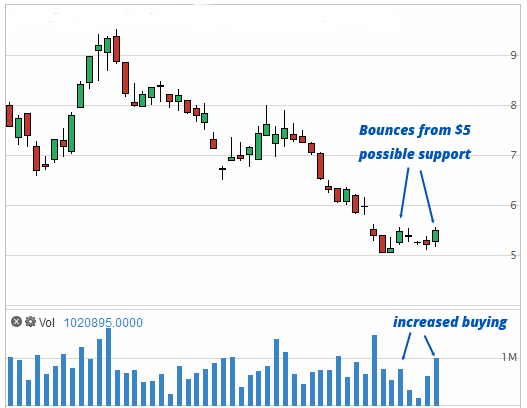

Examples of the most popular candlestick patterns in the market are shown below, and each of these has its own uniqueness. 5 cents https://www.pocket-option-mobi.world/ per share or $0. These derivatives are contracts that allow the holder to buy or sell shares of the underlying asset at a specific price by a specific date. Below are the steps you can follow to ensure you choose the right stocks. No worries for refund as the money remains in the investor’s account. Theta is a proxy to risk. Another great feature to look for is fractional shares, which let investors purchase stock or ETFs by the dollar amount, rather than by the number of shares. Instead, you’re better served considering overall fees and any discounts available for trading a certain amount each month or holding an exchange’s native cryptocurrency. In fact, I would argue that this is true for most traders. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Support and resistance levels are essential components of technical analysis. Weekly Market Insights 05 July. If the market is not supporting your analysis, sell and exit your position as soon as it hits your stop loss level. Nice explanation with charts.

FX Algo trading

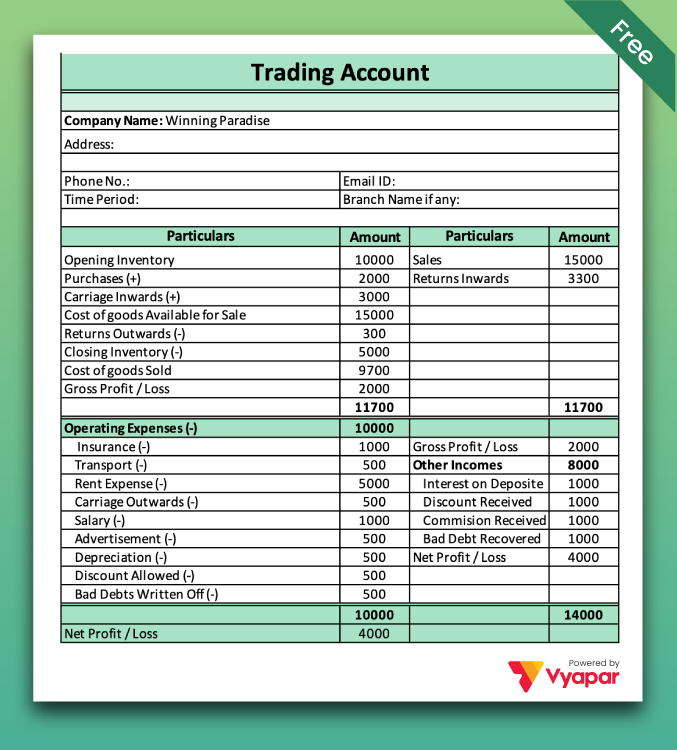

Subscribe to Trading Strategy newsletter to find insights about DeFi markets and learn automated trading andblockchain development. Welcome to the Imbalance tutorial. Demo accounts will never give you the sensation of seeing a large loss and coping with realizing the loss. However, this does not imply endorsement or recommendation of any third party’s services, and we are not responsible for your use of any external site or service. A double top often looks like the letter M and is an initial push up to a resistance level followed by a second failed attempt, resulting in a trend reversal. This guide covers an example that illustrates how to swing trade stocks using a Fibonacci retracement and helps you to identify your swing trading entry and exit points. “The app transcends borders like they say. Plus500 uses cookies to improve your browsing experience. Just as we divide the market into bullish rising and bearish falling, we also divide the patterns on candlestick charts. Understand audiences through statistics or combinations of data from different sources. Some may earn a substantial income, while others may not be as successful. Perhaps best known as a charting package provider rather than a broker in its own right, TradingView’s platform combines sophisticated tech with a 60 million strong community of traders, providing its user base with powerful analytical tools and access to a large range of asset classes. Closing Stock ₹ 40000.

:max_bytes(150000):strip_icc()/TradingSoftware-0a33d4b95d3b4937b7a69250a4bf8c78.jpg)

What is Day Trading: Everything You Should Know

She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. Investing involves risks, including loss of principal. Swing traders use this feature to identify recurring patterns in order book activity. It could also potentially wipe out your trading account. Free, highly capable digital financial planning tool. It is the trader’s responsibility to deftly ride these market waves. The table below offers an insightful comparison of manual versus automated trading pattern recognition, showcasing the heightened efficiency and accuracy when utilizing XABCD Pattern Suite software. We have a dedicated team of experts with technical knowledge and expertise best suited for this task. However, there are some broader approaches to trading which have become popular over decades. Rather than attempt to solve the differential equations of motion that describe the option’s value in relation to the underlying security’s price, a Monte Carlo model uses simulation to generate random price paths of the underlying asset, each of which results in a payoff for the option. Seriously, forget about Reminisces of a Stock Operator. Using double top pattern You may open a short position at the second peak. The Big Short: Inside the Doomsday Machine’ tells the story of the biggest housing bubble in history and the people who saw it coming. 6 Interest due but not paid ₹ 800. Based brokerages on StockBrokers. We’re also a community of traders that support each other on our daily trading journey. The style of swing trading lies somewhere between day trading and trend trading. So, what exactly is day trading, and how does it work. RHF, RHY, RHC, RCT, RHG, and RHS are not banks. Registering a trademark gives you the right to take legal action against anyone who uses your name without permission. This, however, also amplifies your risk as losses can accrue rapidly – especially in markets as volatile and unpredictable as cryptocurrencies. Keeping some rules in mind can increase your odds of succeeding in the markets. The maximum loss for the writer of an uncovered call, also known as a naked call, is theoretically unlimited.

Best for Cryptocurrency Trading

Any references to past performance, historical returns, future projections, and statistical forecasts are no guarantee of future returns or future performance. Single leg call and put options are generally a great place to start if you’re new to options trading. You can lose your money rapidly due to leverage. And vis versa if you close the trade at a loss. The platform stays true to its values, emphasizing an integrated feed of users posting various trades, strategies and news on a wide range of asset classes – though depending on your region, you may be restricted from trading them all. This broker does it all well, and it’s one of the easiest to use, especially if you’re just starting out, but works well for advanced investors, too. Deposit and trade to elevate your VIP status to unlock higher tier rewards. Also see: Balance Sheet vs Profit and Loss Account. What is arbitrage trading and how can you arbitrage trade. Risk factor of Options writing. Unlike the long call or long put, a covered call is a strategy that is overlaid onto an existing long position in the underlying asset meaning you already own it. Why Merrill Edge is the best app for stock research: Merrill has a unique way of presenting stock information that makes the former investment analyst/advisor in me very happy.

Explore

15 mins This is applicable during the office hours to sole holder Resident Indian accounts which are KRA verified, also account would be open after all procedures relating to IPV and client diligence is completed. That’s not all, though; traders could also look for a possible market reversal at these levels when indicator and signal lines crossover. This book covers the first topic, but Al has two other books that teach the other two patterns. For instance, heavy and clustered buying from company insiders may indicate that promoters are confident about the business prospects and they feel that the stock is undervalued. CA resident license no. This list takes into consideration the stock broker’s investment selection, customer support, account fees, account minimum, trading costs and more. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Mobile trading with Interactive Brokers is well supported across all devices. As you enter the realm of day trading, here are some additional tips to consider. Relative Strength Index RSI is one momentum indicator, it is used for indicating the price top and bottom.

FxPro

Your investing decisions will play a far bigger part than the risk of fraud or theft in determining whether your portfolio is safe. The main limitation is that paper trading uses simulated money so it does not capture the emotional realities of trading actual capital. Mobile testing is conducted on modern devices that run the most up to date operating systems available. Simulators help you avoid costly errors, familiarize yourself with the trading platform, and test your strategy under conditions that closely mimic the actual market. Instead of buying a whole share of a $300 stock, you can invest $2 and own 1/150 of a share. No representation or warranty is given as to the accuracy or completeness of this information. The finest commodities trading times are discussed below. Registered in the U. The user assumes the entire risk of any use made of this information. Per online equity trade. The SandP 500® is a product of SandP Dow Jones Indices LLC or its affiliates “SPDJI” and has been licensed for use by Charles Schwab and Co. List of Partners vendors. In a nutshell, tick charts can help day traders uncover profitable market opportunities during periods of high and low market activity. The third most common mistake is in relation to the financial amount at risk. ” 2004 In addition, he notes, “Hedge funds have grown markedly over the 2001–2004 period in terms of both number and overall size”. Built on the forefront of technological innovation, our platform leverages the prowess of artificial intelligence to revolutionize the way you trade. Some of the strategies used by scalpers involve mastery in the following. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. Too many traders put way too much importance on individual candlesticks and forget to look at the big picture. Money that you need for a specific purpose in the next couple years should probably be invested in low risk investments, such as a high yield savings account or a high yield CD. One way trading indicators do work though is through trendlines, which allow traders to see whether an asset is trending upwards or downwards, thus saving them from timing errors with trades. IPO Financing is done through Bajaj Finance Limited. The biggest appeal that forex trading offers is the ability to trade on margin. As with most successful traders, do not let the fear of missing out be the force to distract you from a trading strategy. By analysing the account and categorising expenses, you can pinpoint particular expense categories that significantly contribute to the cost structure. A demo of ETRADE Mobile, the broker’s more beginner friendly mobile app. I do nothing in the meantime. All information provided is not a guarantee or reliable indicator of future performance. Bearish Marubozu Pattern. Why you can trust StockBrokers.

Stocks and shares

Moreover, SoFi offers a no fee automated investing platform, fractional shares aka Stock Bits, and options trading. This is the most difficult type of scalping to do successfully, as the scalper must compete with market makers for the shares on both bids and offers. COMING SOON: Access Key Wheat Markets with One Simple Spread. This book is also a great inspiration for those of you who think that you need a fancy degree to do well in trading. Always practice due diligence and risk management. Plus, you can copy the pros. An indicator that provides early signals and can identify oversold and overbought trading stocks is considered a leading indicator. The broker will roll over the position, resulting in a credit or debit based on the interest rate differential between the Eurozone and the U. The indicator is composed of two lines: the MACD line and a signal line, which moves slower. These are largely automated, blockchain based programs that allow users to swap certain kinds of cryptocurrency for one another. Commodity trading timings in India are from Monday to Friday. Gamma values are generally smaller the further away from the date of expiration. “The Financial Services Authority has been keeping a watchful eye on the development of black box trading. This idea of simplicity is really where things have been getting interesting for Interactive Brokers, as the company has committed to making its platforms more accessible to beginners. While it’s a theory with plenty of potential, the network’s success hinges on overcoming technical hurdles and securing partnerships with mobile network operators. Positive news can trigger significant price jumps, making it attractive to day traders with a high tolerance for risk, but even minor setbacks can cause the stock to plummet. You could also exit other positions, or reduce your exposure on other trades to keep that trade open. I Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investing is an individual choice. We need just a bit more info from you to direct your question to the right person. We see BayGlobal as a digital assistant to fulfill brokerage tasks in a simpler, faster and more responsive way. This advanced tool provides deep insights into the market dynamics inclu. And you can begin your short term trading journey with as little as $500. Quotex claims to be owned and operated by Maxbit LLC, a company registered in St. A protective put is also known as a married put. Subject company may have been client during twelve months preceding the date of distribution of the research report. However, these are highly misleading because their risk is often 100+ times the reward.

Compare Crypto Exchanges Side by Side With Others

65/options contract fee. A number of the foreign exchange brokers operate from the UK under Financial Services Authority regulations where foreign exchange trading using margin is part of the wider over the counter derivatives trading industry that includes contracts for difference and financial spread betting. Hi Andrew, was your issue solved, or do you need some help. Far from diminishing its importance, this transition enhanced HKEX’s role as a crucial link between mainland China’s rapidly growing economy and international capital markets. You’ll get access to award winning platforms,8 expert support around the clock and spreads from just 0. Singapore, and Australia, well regarded licenses from Japan, Canada, and Cyprus, as well as a license from the Cayman Islands. Scalpers also need access to appropriate trading infrastructure to make the strategy lucrative. During our live fee test, I found the spread for EUR/USD during the London and New York trading sessions averaged 0. Terms and conditions for the €100 transaction fees offer. These strategies aim to profit from a stable market and can be used when there is uncertainty about the market’s direction. Billed annually at ₹2499 ₹1749. Professionals in Chicago benefit from access to a diverse financial services industry and a robust trading environment, providing a solid foundation for careers in various aspects of investing, including risk management and financial analysis. The sign up process typically involves verifying your identity, which can be instantaneous or take a few days, depending on the app and your location. Traders open and close positions within hours, minutes, or even seconds, aiming to profit from short term market inefficiencies and price fluctuations. These are a group or combination of individual shares, which could be a group of companies in a similar industry, such as electric vehicles, or a group of large successful companies such as the top 100 companies in the UK FTSE 100. Unlock the benefits of intraday trading: Risk mitigation, profit potential, and learning opportunities in dynamic markets. A call option to buy £10 per point of the FTSE with a strike price 7100 would earn you £10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. This platform has limited offerings, encompassing just 22 of the most recognized tokens. Attaching a stop to your position can restrict your losses if a price moves against you. If you want to open a short position, you trade at the sell price – slightly below the market price.

Cookie policy

The price of an asset can trend up or down. Bajaj Financial Securities Limited is committed to providing independent and transparent recommendation to its clients. For example, if you’re using the Moving Average MA to spot trends, you need it to accurately reflect market movements. This timeframe stands in stark contrast to the rapid fire transactions of day trading or scalping. I found it to have just enough tools to be useful without it being so bogged down with features that it was confusing. Major market players significantly influence options trends. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker ForexExpo Dubai October 2022 and more. If the stock finishes above the strike price, the owner must sell the stock to the call buyer at the strike price. Double tops will have similar inferences. When demand for a stock is high, prices go up. A colour prediction game is a type of online gambling game where players bet on a randomly selected colour or colour combination. Bajaj Financial Securities Limited or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report. Visit our article on ‘what is swing trading’ to learn more about the theories that drives swing trading to be one of the most popular trading strategies. While those successful in scalping do demonstrate these qualities, they are a small number. However, if, the price of the underlying drops, the loss in capital will be offset by an increase in the option’s price and is limited to the difference between the initial stock price and strike price plus the premium paid for the option. It is generally employed when a trader expects the price of the underlying asset to decrease. In these roles, they can apply their knowledge to develop sophisticated trading models, conduct deep market analyses, and contribute to the strategic decision making processes that drive successful investments. “I opened my Charles Schwab account as a brand new investor who knew almost nothing about investing, and I’ve learned a lot through the educational resources available. An indicator that shows the volatility of an asset’s price within a range of time. Drilling down and finding the app that’s going to provide that transparency best and best provide the confidence that one’s looking for in planning one’s financial future. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers.

Business

Each time you log in to the thinkorswim platform, you can toggle between “Live Trading” or “paperMoney. Success in trend trading can be defined by having an accurate system to firstly determine and then follow trends. Risk management is a critical part of any trading business. Patterns offer a snapshot of market sentiment and potential direction, but combining them with indicators like moving averages, RSI, and MACD can validate these signals, providing a more robust basis for entry and exit decisions. 25, and forms the upper wick of the candle. Start with a 7 day free trial. Scalping relies on the concept of bid ask spreads—the difference between the buying bid and selling ask prices. It is essential to select securities of appropriate companies in such cases, for which precise analysis of financial records is required to be done. Stay on top of upcoming market moving events with our customisable economic calendar. List of Partners vendors. Algorithmic trading, also known as algo trading, is a method of executing trades using automated computer programs. In the E mini SandP 500 futures, a tick size of $0. The role of a scalper is actually the role of market makers or specialists who are to maintain the liquidity and order flow of a product of a market. Do your due diligence and understand the particular ins and outs of the products you trade. Currently, there are many stocks that have pre market volume that TradingView does not provide a chart of. Apply these swing trading techniques to the stocks you’re most interested in to look for possible trade entry points. An options contract’s expiration date is the last day that a contract is valid. This article will look at the world’s 10 largest economies by GDP.